An accidental death and dismemberment (AD&D) claim in Kenner, Louisiana, is a type of insurance claim that provides financial compensation for injuries or death resulting from an accident. This claim covers specific losses such as the loss of limbs, sight, or other body parts, as well as death due to an accident. The claim is made under an AD&D insurance plan (that the insured’s employer may sponsor), outlining the conditions and benefits available for accidental injuries and fatalities.

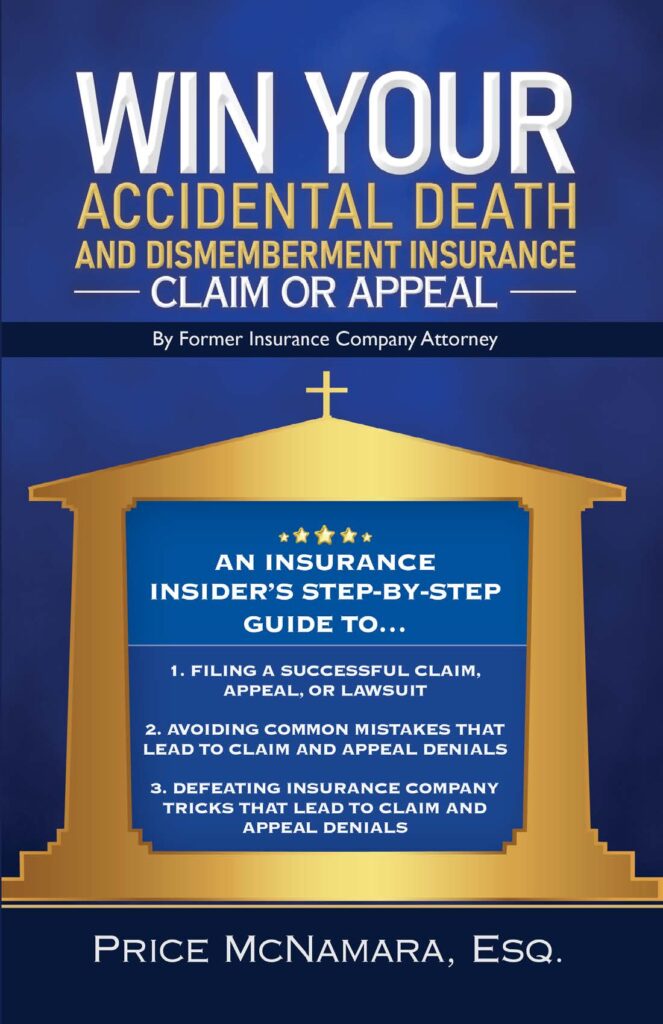

At J. Price McNamara ERISA Insurance Claim Attorney, we can help you secure available benefits under an AD&D policy as quickly as possible.

For a free case evaluation and legal consultation with an experienced Kenner, Louisiana accidental death and dismemberment lawyer, please contact us online for more information.

Kenner, Louisiana accidental death and dismemberment guide

- Why Should We Represent You Throughout Your Case?

- Types of Available Compensation for a Kenner, Louisiana Accidental Death and Dismemberment Claim

- Types of Occurrences that Bring About an Accidental Death and Dismemberment Claim in Kenner, Louisiana

- How to Prove a Kenner, Louisiana Accidental Death and Dismemberment Claim Successfully

- Fighting the Insurance Company in a Kenner, Louisiana Accidental Death and Dismemberment Claim

- Successfully Litigating a Kenner, Louisiana Accidental Death and Dismemberment Claim

- Speak with a Skilled Kenner, Louisiana Accidental Death and Dismemberment Claim Lawyer Right Away

For a free legal consultation with a Insurance Claim lawyer serving Kenner, call (225) 201-8311

Why Should We Represent You Throughout Your Case?

In an AD&D claim, you want the best lawyer to fight for your rights and advocate for your interests. In that regard, you should look no further than J. Price McNamara ERISA Insurance Claim Attorney. We will aggressively handle all negotiations with insurance companies to ensure that you or your family receive the benefits you need. Moreover, we are not afraid to appeal a claim denial or aggressively litigate your case to a resolution in the state court system.

You can view our most recent client testimonials by clicking here.

Our Baton Rouge headquarters is conveniently located at 9431 Common Street Baton Rouge, LA 70809. Let us help you recover the claim compensation you need right away.

Kenner Accidental Death And Dismemberment Lawyer Near Me (225) 201-8311

Types of Available Compensation for a Kenner, Louisiana Accidental Death and Dismemberment Claim

When dealing with an AD&D claim in Kenner, Louisiana, several types of compensation are available to address the financial effect of such tragic events. Understanding these options can help ensure you receive fair compensation for your losses.

- Death Benefits – If the claim involves a death resulting from an accident, death benefits are typically the primary form of compensation. The amount awarded usually depends on the policy terms, but it can offer a significant payout to the deceased’s beneficiaries to cover funeral expenses and outstanding debts – or provide financial support for dependents.

- Dismemberment Benefits – In cases where the accident leads to dismemberment – such as the loss of a limb, eyesight, or other significant body parts – AD&D insurance can provide compensation. The payout for dismemberment is generally outlined in the policy and can vary based on the severity of the injury. Each type of dismemberment typically has a specified amount that will be paid out according to the policy terms.

- Medical Expenses – If the accident involved significant medical treatment before death or dismemberment, compensation may be available for these expenses. This can include costs for hospital stays, surgeries, medications, and rehabilitation services. Documentation of these expenses will be key when filing the claim.

- Lost Wages – In cases where the deceased or injured person was employed, compensation may be available for lost income or earning potential. This can help offset the income that would have been earned had the accident not occurred.

- Pain and Suffering – Although not always covered in AD&D claims, some policies or legal claims may include compensation for the pain and suffering the victim or their family experienced.

- Loss of Consortium – If the victim’s death or injury affects the family’s quality of life, such as a spouse’s loss of companionship, compensation for loss of consortium may be pursued. This compensation recognizes the emotional and relational effect on the surviving family members.

At J. Price McNamara ERISA Insurance Claim Attorney, we can navigate the AD&D claim for you and explore all potential avenues of compensation.

Click to contact our insurance claim lawyers today

Types of Occurrences that Bring About an Accidental Death and Dismemberment Claim in Kenner, Louisiana

AD&D claims in Kenner, Louisiana, arise from various types of accidents that can lead to severe injury or death, including:

- Vehicle Accidents – One of the most common causes of AD&D claims is vehicle accidents. This includes collisions involving cars, trucks, motorcycles, or bicycles. A severe crash can result in fatal injuries or dismemberment, making it a frequent basis for filing an AD&D claim. For instance, a motorcycle accident may lead to the loss of a limb or death, triggering compensation under an AD&D policy.

- Workplace Accidents – Industrial or construction site accidents can lead to significant injuries or fatalities. Examples include falls from heights, machinery accidents, or being struck by falling objects. Such accidents may result in dismemberment or death, and workers or their families can file an AD&D claim to seek compensation for their losses.

- Slip and Fall Accidents – These accidents occur when someone slips, trips, or falls due to hazardous conditions like wet floors or uneven surfaces. Severe slip and fall incidents can cause major injuries or even be fatal, potentially qualifying for an AD&D claim if the injuries are severe enough.

- Recreational Accidents – Accidents during recreational activities, such as skiing, boating, or sports, can also lead to dismemberment or accidental death. For instance, a serious skiing accident may result in the loss of a limb, making it possible to file an AD&D claim if the accident falls within the insurance policy’s coverage.

- Fires and Explosions – Accidents involving fires or explosions can cause devastating injuries or death. Burns, smoke inhalation, or injuries from blasts can be severe enough to warrant an AD&D claim.

- Criminal Acts – In some cases, injuries or fatalities resulting from violent crimes, such as assault or robbery, can lead to an AD&D claim if the policy covers such incidents.

Complete a Free Case Evaluation form now

How to Prove a Kenner, Louisiana Accidental Death and Dismemberment Claim Successfully

To successfully prove an AD&D claim in Kenner, Louisiana, several key steps must be followed. These steps ensure that your claim is well-supported and stands a good chance of being approved.

- Gather Documentation – Collect all relevant documents associated with the accident and its aftermath. This includes medical records, death certificates, accident reports, and any evidence of dismemberment. Medical records should detail the extent of injuries and the treatment received, while the death certificate provides proof of death.

- Obtain an Accident Report – An official accident report from law enforcement or the relevant authority is crucial. This report provides details about how the accident occurred and establishes that it was accidental. The report should clearly state the circumstances and factors involved.

- Review Your Policy – Carefully review the AD&D insurance policy to understand what types of accidents and injuries are covered. The policy will specify the conditions under which claims are paid – and any exclusions.

- Provide Evidence of Coverage – Include proof that you or the deceased were covered under the AD&D insurance policy at the time of the accident. This may include policy documents or premium payment receipts.

- Document the Financial Effects – Prepare a detailed account of the financial effects of the accident, including funeral expenses, medical bills, and any loss of income. This documentation supports your claim by showing the financial burdens resulting from the accident.

- Consult with an Experienced AD&D Lawyer in Kenner – At J. Price McNamara ERISA Insurance Claim Attorney, we can aggressively advocate for your rights, seek expert opinions (if necessary), submit a claim form, and follow up with the insurance company on your behalf.

By following these steps, you can build a strong case for your AD&D claim in Kenner and improve your chances of a successful outcome.

Fighting the Insurance Company in a Kenner, Louisiana Accidental Death and Dismemberment Claim

At J. Price McNamara ERISA Insurance Claim Attorney, we can take several important steps to fight the insurance company and work towards a fair resolution for you. Here’s how we can help:

- Thorough Policy Review – We will start by carefully reviewing your AD&D insurance policy. This helps us understand its specific terms, coverage details, and any exclusions that may affect your claim. By grasping the nuances of the policy, we can ensure that your claim aligns with what is covered and identify potential areas of contention.

- Strategic Negotiations – Insurance companies often aim to minimize their payouts. We will use our strong negotiation skills to advocate for a fair settlement on your behalf. Our goal is to secure the benefits you deserve by negotiating directly with the insurer and challenging any low offers or unjust denials.

- Effective Communication – Navigating interactions with the insurance company can be complicated. We will handle all communications with the insurer, ensuring that your case is presented clearly and your rights are protected. Our involvement helps avoid misunderstandings and keeps the process on track.

- Dispute Denials – If the insurance company denies your claim, we can address the denial by presenting strong arguments and countering their reasons. We will work to overturn the denial by crafting formal appeal letters and preparing legal responses to support your case.

- Legal Action – If negotiations and appeals do not yield a satisfactory outcome, we can escalate the matter by filing a lawsuit. We will handle all legal procedures, including preparing necessary documents, representing you in court, and arguing your case effectively to achieve a favorable judgment or settlement.

- Advocacy and Support – We will be your dedicated advocates throughout the process. We are committed to ensuring that your case is managed with care and skill, always focusing on securing the best possible result for you and your family.

Our role is to fight for your rights and skillfully navigate the insurance process on your behalf.

Successfully Litigating a Kenner, Louisiana Accidental Death and Dismemberment Claim

Successfully litigating an AD&D claim in Kenner, Louisiana, involves a detailed legal process that begins with filing a complaint against the insurance company. Here’s how we can handle this process for you:

- Filing a Complaint – The first step is to file a formal complaint with the court. This document details your AD&D claim, including the nature of the accident, the injuries or death involved, and why the insurance company is responsible. We will carefully draft this complaint to ensure it meets legal standards and accurately represents your case.

- Serving the Defendant – After filing the complaint, it must be served to the insurance company. We will handle this process, making sure that the insurer receives proper notice of the lawsuit and has an opportunity to respond. Proper service is vital for moving the case forward.

- Discovery Process – During discovery, both sides exchange information and evidence related to the case. We will request documents, records, and other relevant information from the insurance company to support your claim. Additionally, we will respond to any requests from the insurer, ensuring that all necessary information is shared. This phase helps us gather evidence and understand the strengths and weaknesses of both sides.

- Pre-Trial Motions – Before the trial, there may be pre-trial motions where we ask the court to make decisions on specific issues or dismiss parts of the case. We will handle these motions, presenting arguments to strengthen your case and address any legal challenges.

- Trial Preparation – As we prepare for trial, we will organize evidence, prepare witnesses, and develop a strategy for presenting your case. Our goal is to present a compelling argument that clearly demonstrates the insurance company’s liability and the extent of your damages.

- Trial – During the trial, we will present your case to the judge or jury. This involves making opening statements, introducing evidence, and cross-examining witnesses. We will work to effectively communicate the facts and persuade the court to rule in your favor.

- Post-Trial Motions – If necessary, we will handle any post-trial motions or appeals. If the insurance company challenges the verdict or if other legal issues arise, we will take the appropriate steps to protect your interests and seek the compensation you deserve.

By managing these steps with skill and dedication, we can successfully litigate your AD&D claim against the insurance company and work towards achieving a favorable outcome.

Speak with a Skilled Kenner, Louisiana Accidental Death and Dismemberment Claim Lawyer Right Away

At J. Price McNamara ERISA Insurance Claim Attorney, we will work hard to secure the fair benefits and compensation that you or your family need at this difficult time. For a free case evaluation and legal consultation with a knowledgeable Kenner, Louisiana accidental death and dismemberment lawyer, please contact us at (225) 201-8311 or visit us online.

Baton Rouge Office

Call or text (225) 201-8311 or complete a Free Case Evaluation form